We’re so excited to have you as a member.

Now that Community Bank is part of STCU, we want to make sure your transition is as smooth as possible.

This page will be updated regularly with new information, so check back often.

On this page: Latest updates | Integration info | General FAQ

Latest updates. Updated 5/14/25.

Community Bank and STCU integrated on Friday, May 9. All 10 branches reopened on Tuesday, May 13, as STCU branch locations.

Actions to take.

Activate your debit card and set your pin when it arrives by calling the number on the front of the card or using online banking at stcu.org/activate. Businesses, please call the number on the sticker found on the front of the card.

Log in to online banking for the first time once you receive your credentials. Double check your Billpay payees and payment amounts. Note: Please don't register for STCU online banking.

Integration information. Updated 5/9/25.

Frequently asked questions. Updated 5/9/25.

About the integration.

Will I still be able to use my current checks?

Yes. You may continue to use your remaining Community Bank consumer and business checks to draw on your STCU checking account until they're used up.

When will I receive my STCU member number and account numbers?

Your STCU member number and new account numbers are available in our onboarding tool.

Will my current direct deposit and automated regular withdrawals still work?

Yes. STCU is assuming Community Bank's routing number, meaning direct deposits, outgoing and incoming automatic ACH payments and credits, checks, and all internal transfers set up through Community Bank will convert automatically. However, any automatic payments made with your Community Bank debit card will need to be updated by providing the merchant with your new STCU debit card number after your card is activated on May 9.

Are you closing Community Bank branches?

No. All 10 Community Bank branches will be converted to STCU branch locations. In addition, you'll see the same friendly faces when you visit your favorite branch location.

What about online banking?

Access to Community Bank online banking and Community Bank's website ended on May 9 at 2 p.m.

You’ll receive your online banking login credentials by end of day May 11 and be able to use them to log in when they arrive. Please don't register for STCU online banking – you are already automatically registered.

Will this interrupt my Social Security direct deposits?

No. If you’re receiving Social Security payments, we encourage you to change the direct deposit information as soon as possible after the integration of STCU and Community Bank. However, even if you forget to make the change, or if the Social Security Administration is slow to react, any deposits directed to your old Community Bank account will be re-routed to your STCU account. There’s no risk in missing a deposit due to the integration of our two organizations.

I have a loan with Community Bank — will it transition to STCU?

Yes. Unless otherwise specified, STCU will honor the current rate and term on your existing Community Bank loans. If you use a credit monitoring service, your Community Bank loan will close, and a new loan from STCU will appear in its place. Your move to STCU will not impact your credit score.

However, please note that your Community Bank credit card will not make the move to STCU; it will remain serviced by your current administrator, TIB.

Why did Community Bank choose to integrate with STCU?

Primarily, client convenience and sustainability. STCU’s products and services, along with its member-focused approach to banking, line up well with Community Bank. Plus, STCU’s brick and mortar commitment to serving rural markets will ensure that Community Bank clients have uninterrupted access to the financial services they need.

What will happen to my favorite Community Bank employees?

Community Bank employees are your friends and neighbors and highly skilled financial professionals. That’s why it’s STCU’s intention to offer positions to all. Specifics about those opportunities will be discussed directly with each team member.

Does STCU offer the same services as Community Bank?

Banks and credit unions offer many of the same services, and you’ll find that your Community Bank accounts align well with similar accounts at STCU. Like Community Bank, the credit union offers an array of savings and lending products, home loans, credit cards, and more – for consumers and businesses alike.

About STCU.

Who owns STCU?

As a not-for-profit cooperative, we’re owned by our members. Our headquarters is located in Liberty Lake, WA, just east of Spokane. Read about the credit union difference.

Isn’t STCU just for teachers?

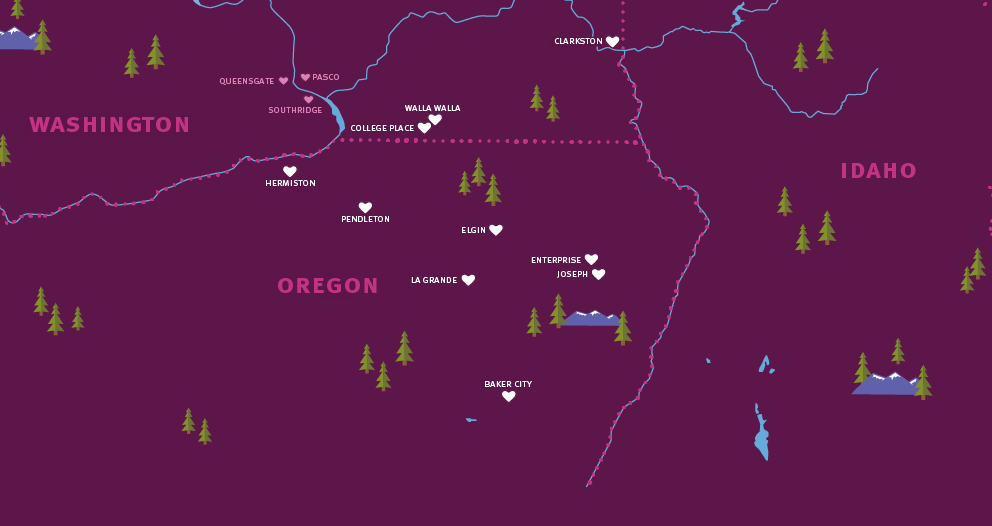

We were founded by teachers in 1934, but our membership now is open to nearly anyone in Washington, North Idaho, and eligible counties in Eastern Oregon, plus others who meet certain qualifications. And we’ve been named the region’s favorite credit union for 16 consecutive years. Read more about membership.

Is there a fee for joining STCU?

We’re waiving our membership fee for Community Bank clients.

I have FDIC Insurance coverage on my deposits today. Will that change when I’m with STCU?

STCU accounts are federally insured by NCUA with up to $250,000 covered, which is the same as FDIC coverage. This coverage will automatically be in place when your deposits transition to STCU. Read more about NCUA coverage.

Can a local credit union provide 24/7 access to my accounts, even when I’m out of town?

When it’s not convenient to visit an STCU branch location, you may access your accounts at thousands of surcharge-free ATMs nationwide. STCU also has a robust mobile app, online banking, and local contact center, so you’ll always have a way to make transactions and check your account balances from anywhere. We have members living in all 50 states, and abroad.

Is STCU here for good?

As a matter of fact, we are. STCU is increasing its commitment to the community, through both brick-and-mortar and digital expansion.

Where do I call for more information?

We’ve set up a dedicated number for Community Bank clients. Give us a call at (888) 782-8669. We look forward to hearing from you!